One the most popular and versatile tools of technical analysis is the moving average (MA). MAs are classified as “lagging” indicators, meaning that they trail the prevailing price and are studies of previously occurring price action. MAs are not intended to predict breakouts or forthcoming trends in the market. Instead, they are designed to identify or confirm an established trend in pricing.

Types of Moving Averages

Traders calculate moving averages in a myriad of different fashions, each with a varying degree of sophistication as well as a specific objective. No matter what type of MA is being constructed, its value is derived using pricing data exclusive to previous periods.

The two most commonly implemented moving averages are:

- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

Any trades are educational examples only. They do not include commissions and fees.

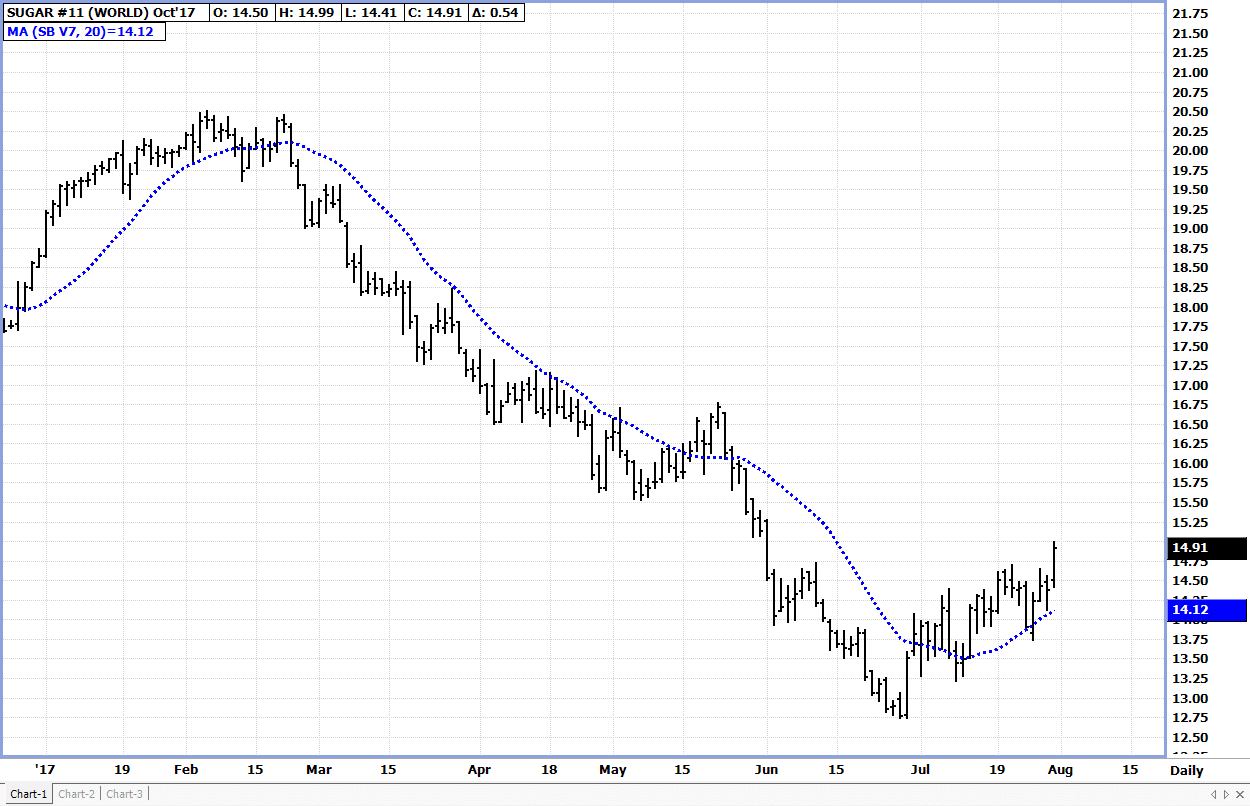

Simple Moving Average (SMA)

The SMA is the most basic variety of moving average. You can calculate an SMA by taking a collection of price values for a desired number of periods, then dividing the chosen value by the number of periods. As the SMA moves forward in time, replace the first price value of the series with the most current value, updating the calculation.

Source: FutureSource

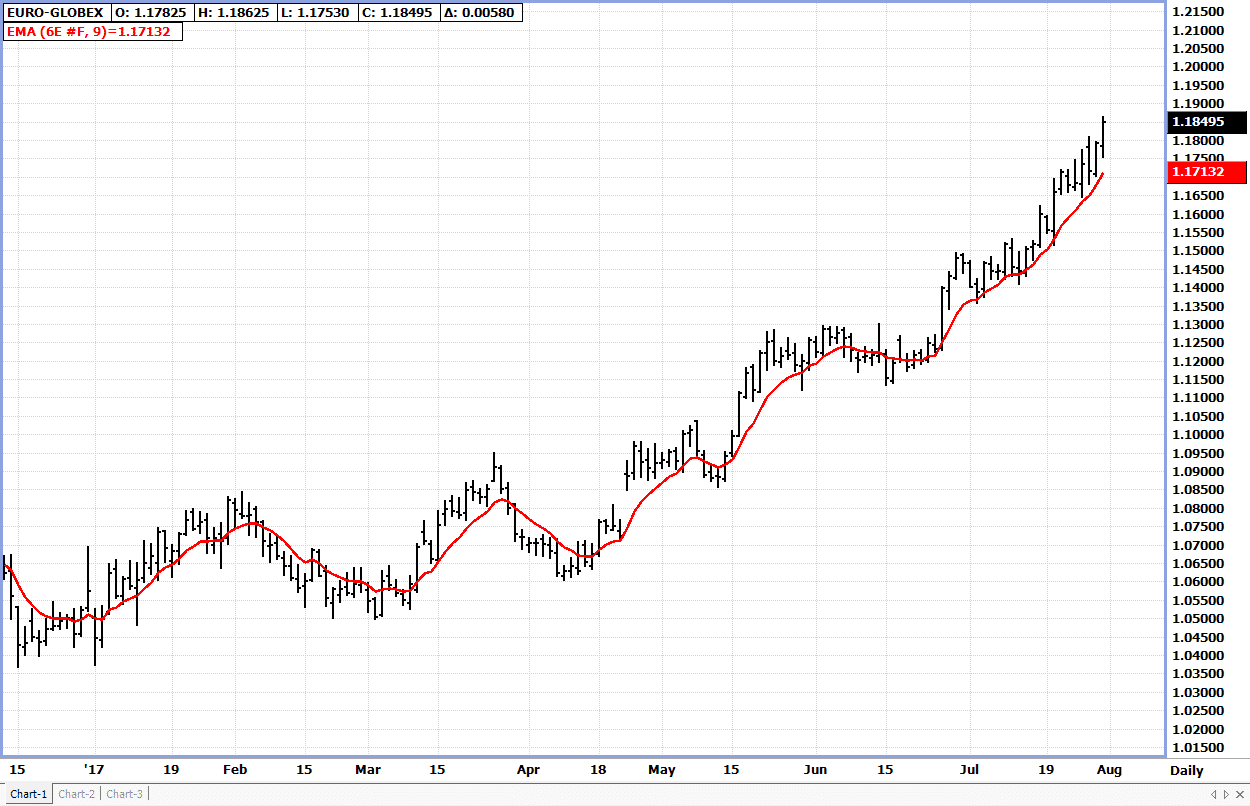

Exponential Moving Average (EMA)

You can calculate EMA in much the same manner as the SMA, except the most recent price values are assigned greater relevance or “weight.” As a result, the EMA attempts to reduce lag by giving more validity to the most recent price action. MA calculations may be as simple as the SMA or extremely complex. In many cases, hybrid MAs are constructed from mixing elements of the SMA and EMA with more radical concepts.

Source: FutureSource

Applications of Moving Averages

Always keep in mind that MAs are limited in their predictive capabilities. In contrast to technicals — such as oscillators, volume indicators, or chart patterns — MAs do not aid in identifying market reversal or the location of a potential breakout.

However, MAs do provide useful insights into market behavior. Many technical traders and investors alike incorporate the use of MAs into their trading plans for use in the following areas:

- Trend Identification

- Pricing Momentum

- Support and Resistance

Trend Identification

The number one trading axiom is “the trend is your friend.” A considerable number of trading methodologies strictly adhere to this rule, aiming to either get in on, or avoid going against, the current trend. Moving averages make trend recognition routine, because they are typically represented linearly on the pricing chart. The slope of the MA and its location in respect to the current price are both indications of a trend’s existence. If price action is above the MA, an uptrend is present; if below the MA, a downtrend is ongoing.

Any trades are educational examples only. They do not include commissions and fees.

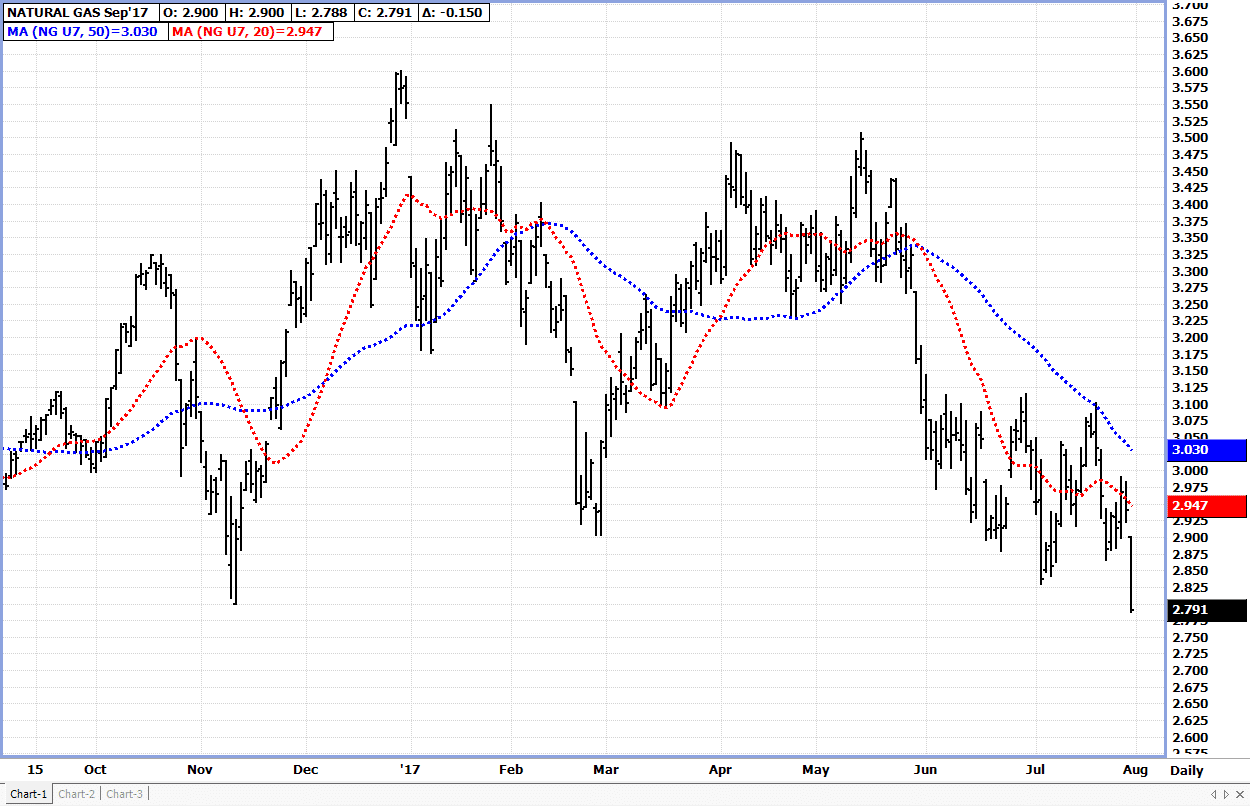

Pricing Momentum

Although MAs are not a momentum indicator on a stand-alone basis, traders frequently use them in concert with one another within a multi-time frame context. Traders can compare MAs with short-term durations to MAs with longer durations in order to establish the relative strength of price action. For instance, if a short-term MA is located above a longer-term MA, then price action is currently trending upward. In the event that the short-term MA is also diverging from the long-term MA, then the current momentum of price action has increased.

Source: FutureSource

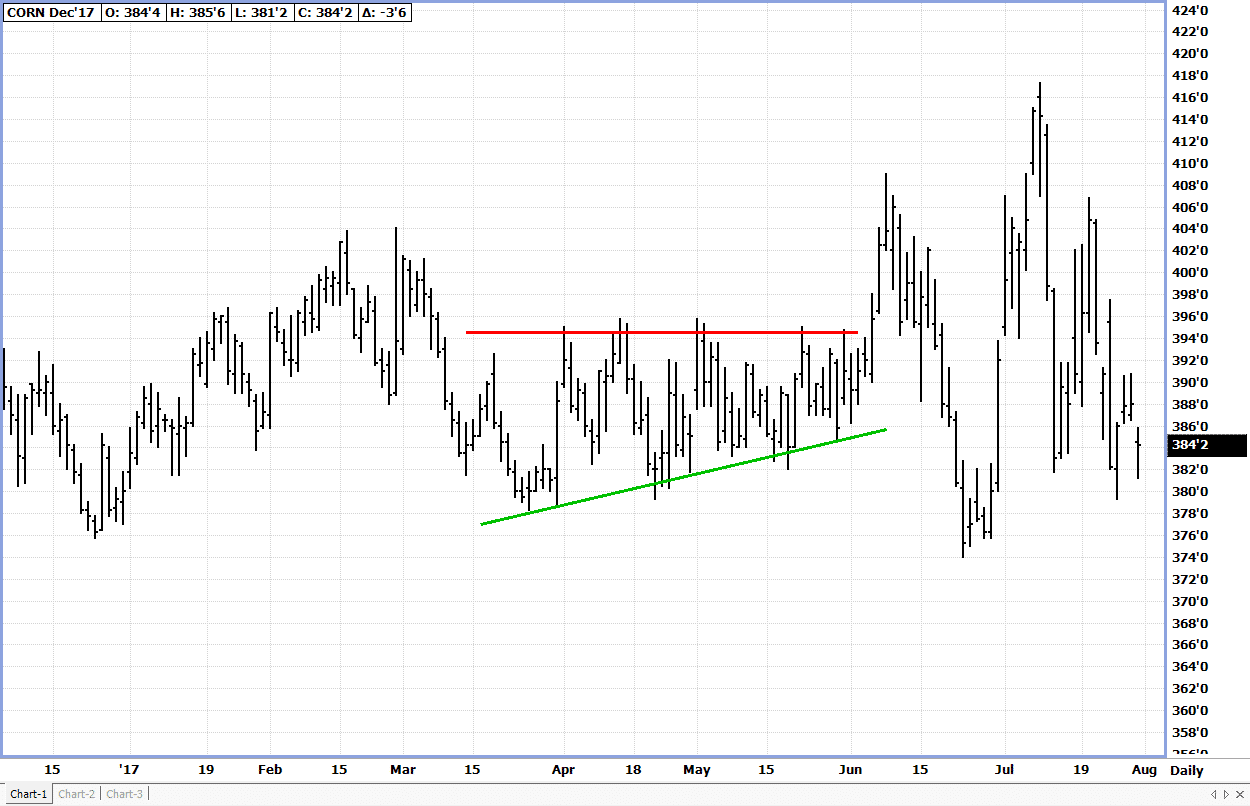

Support and Resistance

The location of a popular MA is often perceived to be a key technical level — and one that may prompt increasing market participation. Many traders view MA values as guidelines of when to enter or exit a trade. For instance, in the event that price crosses over an MA, it may be interpreted as an indication that the current trend is over, and an exit from opposing positions may be warranted. Conversely, this type of scenario may entice some traders to enter the market in anticipation of a fresh trend being confirmed.

Source: FutureSource

Integrating Moving Averages into Your Trading Plan

Whether you’re a purely technical trader or an investor that makes decisions based upon fundamentals, MAs can be a valued addition to nearly any comprehensive trading plan.

However, selecting the most effective MA for your trading approach can prove to be a challenge. Each type of MA is a bit nuanced and is likely best suited for a specific product, market, or trading style. For individuals new to technical analysis, or the marketplace in general, consulting an experienced market professional may be a great way to optimize the utility of moving averages.