This blog covers common topics about contango and backwardation in the commodity markets. What they are? How they are different? What are their functionalities? What causes these distinctions? These relevant questions will all be addressed below.

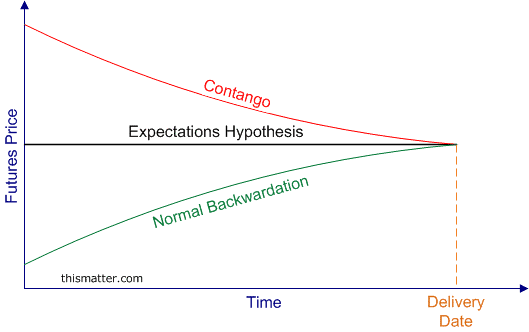

The commodity world commonly uses two terms when relating future price formation via a forward price curve, with respect to supply and demand. These terms, contango, and normal backwardation refer to the pattern of future prices over time. Contango is a situation where the futures price of a commodity is higher than the expected future spot price (supply-driven). The opposite of contango is when a futures market is in normal backwardation. This means that the price of a futures contract is trading below the expected future spot price of that commodity (demand-driven).

Understanding Normal and Inverted Markets for Long-Term Positions

Recognizing when a commodity is in a normal (contango) or inverted (backwardation) market is critical when a market participant is considering entering into a long-term position in a futures contract. These distinctions are necessary when trading commodity futures because it tells traders what type of market the commodity is in and which direction the futures price must move towards in the long run. With that being said, scalpers and intraday traders do not really worry about these aspects when trading a commodity. The typical day trader will most likely use technical analysis and will be able to profit (or equally lose) off short-duration price movements in the market. Technical analysis is a completely different strategy compared to one used by a trader looking for seasonal trends in a futures market.

Markets in Contango

If a commodity market is in contango, the forward price curve is considered to be in an “upward-sloping” or normal market. The future spot price is trading below the futures contract price. As a result, the futures price must fall with respect to the spot price as time of expiration arrives. Conversely, a commodity market in backwardation shows the forward price curve to be in a “downward-sloping” or inverted market. In this circumstance, the futures price will rise with respect to the spot price as time decays for a particular futures contract.

Note: The image above is in regard to the futures price, not the spot price (forward curve).

Forward price discrepancies for the most part are attributed to carrying costs. In the physical commodity markets, the cost of carry includes the necessary insurance, the expense of storing the physical commodity over a period of time, and interest on the underlying investment. Theoretically, the price of a futures contract is the sum of the prevailing spot price plus these costs of carry. This would infer that the futures price is always greater than the underlying spot price. Unfortunately, this is not always the case, which is what we see in backwardation price formations.

Markets in Backwardation

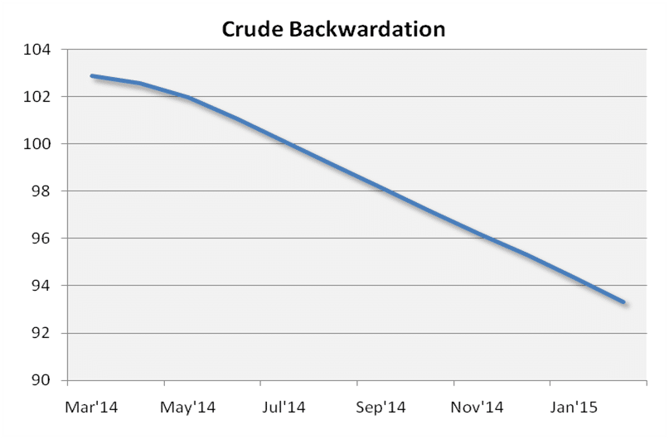

Backwardation is infrequently seen in the commodity markets but sometimes does occur due to unexpected and disastrous events. One market we have seen in backwardation in recent years is WTI Crude Oil.

Any trades are educational examples only. They do not include commissions and fees.

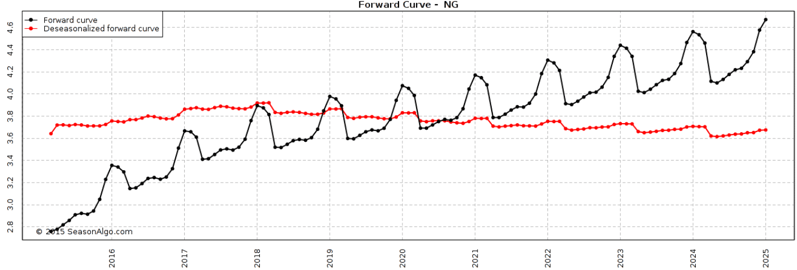

A crisis in the production of oil can cause a shortage, which limits the supply in the spot market. As a result, the current demand for the commodity rises rapidly as the spot price climbs above the futures price. The need to own the underlying commodity at the current time outweighs the carrying costs seen in the future. Shortages in supply are the primary cause for backwardation. They tend to arise due to seasonality changes in a particular market. The relative demand for a specific physical commodity can create too large of a drawdown in inventory, which can potentially force the futures market into backwardation. We see this occur often in the Natural Gas market. The seasonality seen in this market continues to present a high demand in winter months due to the need for heat.

Whether a particular futures contract is trading in contango or backwardation in regards to the spot price, eventually the contract will expire and the two prices will meet in equilibrium. During the lifetime of the futures contract, it will offer discrepancies in these markets where traders can attempt to profit using technical analysis overlaying fundamentals. Seeing unfair highs or unfair lows offer traders the opportunity to take advantage of differences seen in the futures price compared to the spot price. Traders also have an equal likelihood to lose in these markets so these actions must be taken with great consideration and caution.