The Commitment of Traders (COT) Report is conducted by the Commodity Futures Trading Commission (CFTC) detailing the open interest in each futures and options on commodities markets containing 20 or more traders holding position sizes large enough to meet the CFTC’s reporting level. The purpose of this report is to provide traders with transparency in regards to the open interest in various futures markets and the sizes of those positions for different groups of traders. Open interest is the total number of open futures or options positions that are not closed or delivered on in a particular day. The COT Report is released every Friday and is based off of data at the end of the prior Tuesday’s trading session. Ultimately, the COT Report is an excellent resource to use in order to gain insight into the position sizes of different types of traders and how the position sizes change over time.

The COT report is separated into five categories to differentiate the types of traders who have positions in a market, and three sub-categories to differentiate the types of positions. The COT Report also breaks down four statistical categories.

Trader Categories

- Processors/Users – Processors or users are traders who use the futures markets as a hedge to the physical commodity in the cash market. These traders include producers of the commodity, consume mass quantities of the commodity or trade the commodity in the cash market.

- Swap Dealers – Swap dealers, as defined by the CFTC, is “an entity that deals primarily in swaps for a commodity and uses the futures markets to manage or hedge the risk associated with those swaps transactions.” In other words, swap dealers are typically traders who take the other side of trades for hedgers and large speculators.

- Managed Money – These traders are Commodity Trading Advisors (CTAs), Commodity Pool Operators, or hedge funds that hold large speculative positions in the futures.

- Other Reportable – Traders outside of the three categories listed above that have substantial positions, as defined by the CFTC, in a market.

- Non-Reportable – Traders outside of the first three categories listed above that have small positions, as defined by the CFTC, in a market.

Position Categories

- Long – This is the number of traders that are long the market.

- Short – This is the number of traders that are short the market.

- Spreading – This represents the number of offsetting positions in a particular trader category.

**Long and short represent any remaining positions after offsetting.

Statistical Categories

- Position size

- Changes in position size from the previous week

- Percent of open interest represented by each category of trader

- Number of traders in each category

**All of these categories can be viewed in the image below reflecting the COT Report data for Corn Futures as of April 29th, 2014.

How to Access the COT Reports

CFTC

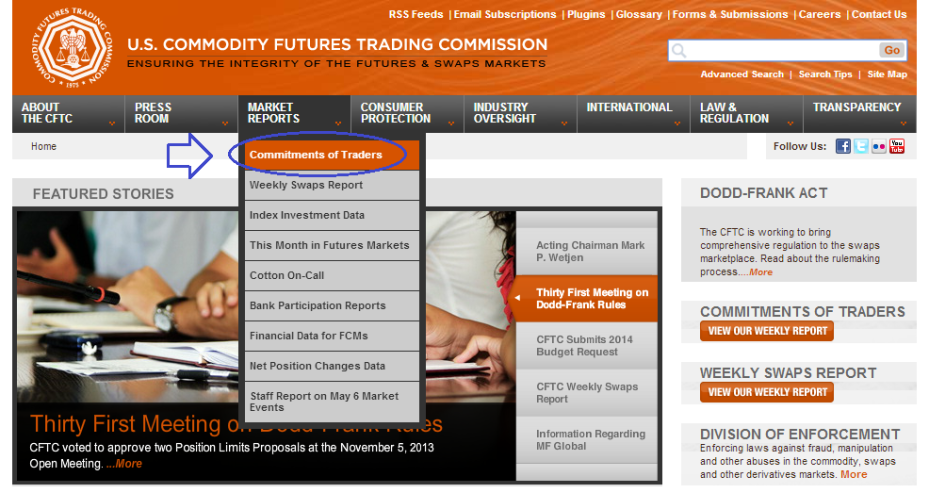

You can find the COT Reports on CFTC’s website. To locate the reports on their site, simply follow the steps below:

- Go to www.CFTC.gov

- Select Market Reports

- Select Commitments of Traders

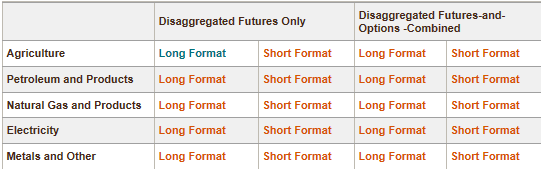

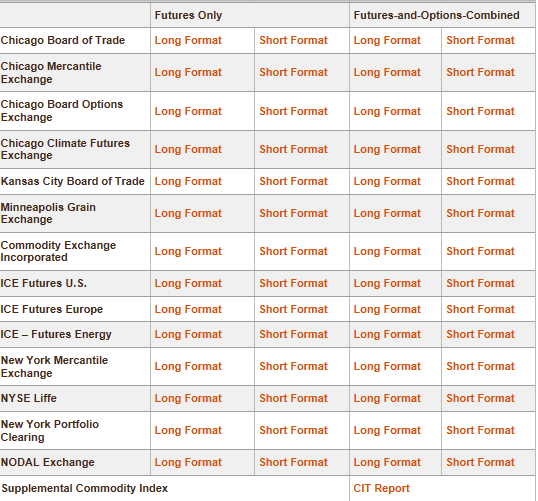

- The next page will allow you to view the COT Reports with choices to filter the data by the following, as well as choose whether you would like to view the data in a long or short format:

Market Sector (disaggregated futures only or disaggregated futures and options combined):

Exchange (futures only or futures and options combined):

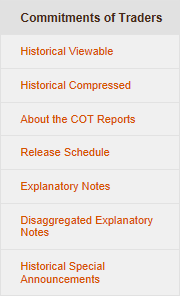

- Traders also have the ability to view past COT Report data, and learn more about the meaning of the COT Report in the window below:

Ultimately, the Commitment of Traders Report is an excellent resource that traders may use in order to gain insight into the position sizes of different groups of traders. Plus, the COT report allows traders to see how these position sizes vary overtime. The COT Report is important for traders to understand because it can reflect when different groups of traders have a more bearish or bullish outlook in a market, as it displays the number of long and short positions that group has in a market, and how these position sizes vary week to week.

The main objective that traders look for in the COT Report is the long and short positions that different groups of traders are holding and how they compare to past COT data. For example, if there is an all-time high of long positions in the corn market for managed money, this would be a great indicator that large speculators in the corn market are extremely bullish. It is also an indicator for contrarians that a short opportunity may be developing if all the longs find reason to exit the market over a short period of time. There are many ways to decipher the COT Report to help traders gain an edge in the market.