The primary resources to use when trying to find futures spread margins listed at the CME Group and ICE Exchange are the CME Group’s website and the ICE Exchange’s website. Clients of Daniels Trading have the added benefit of viewing futures spread margins on our flagship trading platform dt Pro in addition to our dt Vantage platform. This article will give you detailed instructions on where to find futures spread margins using the resources mentioned above.

How to Use CME Group’s Website to Locate Futures Spread Margins:

-

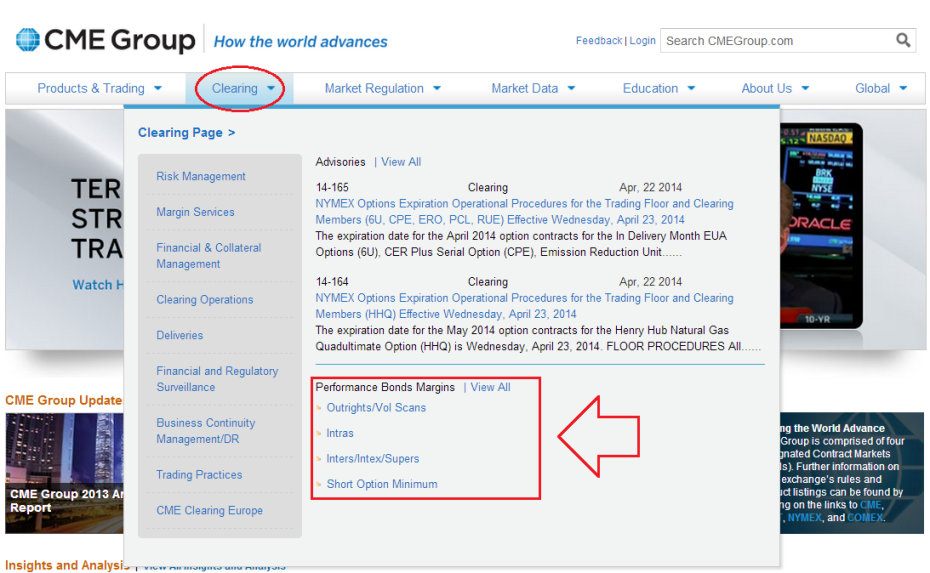

- Go to www.CMEGroup.com.

- Select Clearing at the top of the CME Group homepage.

- Under Performance Bonds Margin:

- Select Intras if you would like to view the margin requirements for exchange listed intra- commodity futures spreads.

- Select Inters/Intex/Supers if you would like to view the margin requirements for exchange listed inter-commodity futures spreads.

-

- When selecting Intras, one will come to the following page where they are given the option to filter specific intra-commodity spreads by Exchange, Asset Class, and Product.

- When selecting Inters/Intex/Supers, one will come to the following page where they are given the option to filter specific inter-commodity spreads by Exchange, Asset Class, and Product.**Please note, to search for inter-commodity futures spreads in the following window, type only one of the products in which you would like to view the spread for, then search for the spread between the two commodities. For example, if a trader would like to view the margin requirements for a Corn/Wheat spread, that trader would type corn or wheat under Product, and then search for the Corn/Wheat spread they want to view the margin requirements for in the results.

**Please also note, the CME Group provides a spread margin credit percentage on their website for inter-commodity futures spreads rather than a dollar amount. This percentage can be found under the Credit section (as seen in the picture below). To calculate the margin rate simply add the two contracts being spread and multiply by the percentage given.

How to use ICE Exchange’s website to locate futures spread margins:

-

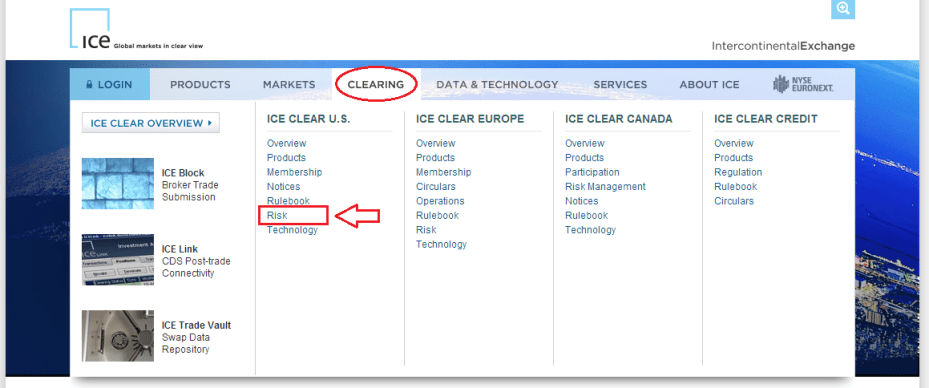

- Go to www.TheICE.com.

- Select Clearing at the top of the homepage.

- Select Risk

-

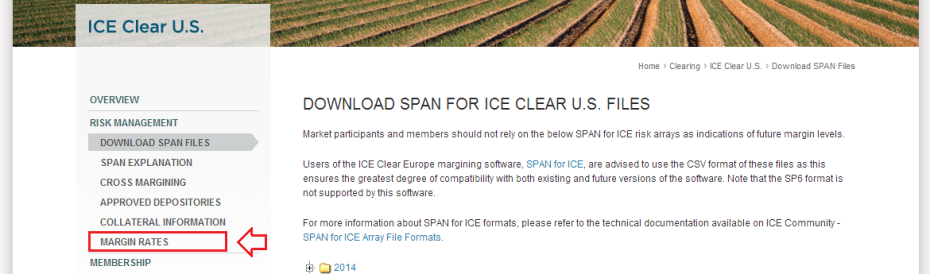

- On the next page, select Margin Rates.

- After selecting Margin Rates, the next page will contain all of the margin rates for ICE Exchange listed products.

- Intra-commodity spreads, also known as calendar spreads, and margin requirements begin on page 5 of Margin Rates.

- To help you understand the format of the intra-commodity spread margin requirements listed on the ICE Exchange’s website please view the explanation below:

- Tiers listed vertically represent the front month being traded in the spread.

- These months are in order from the earliest month of the futures contract to the furthest out month.

- For example, T1 on the vertical axis represents the current front month of the commodity being traded.

- Tiers listed horizontally represent the back month being traded in the spread.

- These months are in order from the month immediately following the front month to the furthest out month.

- For example, T2 represents the contract month immediately following the front month of the commodity being traded.

- Inter-commodity spread margin requirements begin on page 29 of Margin Rates.

- Inter-commodity spread margin requirements can be calculated by taking the percentage, listed under Savings Percentage,of the combined margin requirements of the contracts being traded against each other.

As an added benefit to Daniels Trading clients, traders are able to calculate futures spread margin rates using our Risk Analyzer on our dt Vantage trading platform, or by using our Margin Calculator on our dt Pro trading platform. To learn more about the software Daniels Trading offers to self-directed traders, I encourage you to contact me at 312.706.7633.

Risk Disclosure

THE RISK OF LOSS IN TRADING COMMODITY FUTURES AND OPTIONS CONTRACTS CAN BE SUBSTANTIAL. THERE IS A HIGH DEGREE OF LEVERAGE IN FUTURES TRADING BECAUSE OF SMALL MARGIN REQUIREMENTS. THIS LEVERAGE CAN WORK AGAINST YOU AS WELL AS FOR YOU AND CAN LEAD TO LARGE LOSSES AS WELL AS LARGE GAINS.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI does business as Daniels Trading/Top Third/Futures Online. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2023 StoneX Group Inc. All Rights Reserved

You must be logged in to post a comment.