Many traders get confused on how futures spreads are quoted compared to the outright futures contracts in a particular commodity. If trading an exchange listed inter-commodity spread (two different commodities like Corn vs Wheat), the quote will be the difference between the prices of the two commodities that the trader is spreading (Corn Price – Wheat Price). Which commodity comes first in the equation varies on the inter-commodity spread being traded, but this is something your StoneX broker can quickly help you figure it out.

Every intra-commodity spread involves being long one contract maturity and short another. Keep in mind an intra-commodity futures spread is always quoted as the front month minus the back month. For example, if a trader was spreading May 14 Corn and September 14 Corn, the trader would simply subtract the September corn price from the May corn price to get the current price of the spread. So, for example, if the trader is selling the May corn contract and buying the September corn contract, the market price would be the May bid minus the September offer. Ultimately, even though futures spreads are made up of two individual futures contracts, they are quoted as the difference between the two, resulting in one bid/ask for the spread.

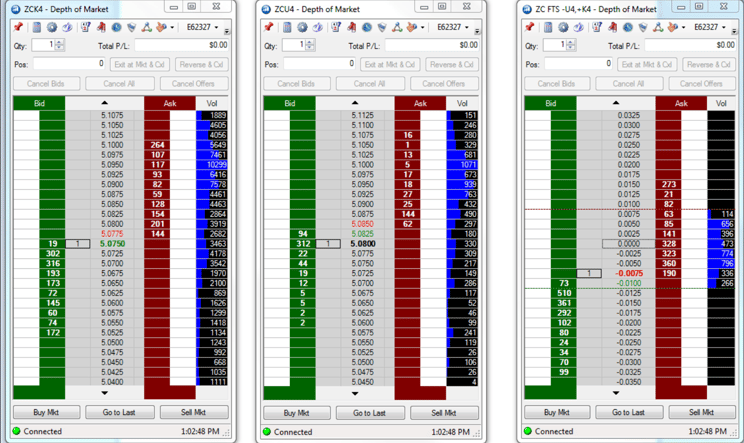

To get a visual of spread pricing, let’s take a look at the Depth of Markets for May corn, September corn, and the May/September corn spread below. Notice that the bid/ask for the spread is -0.0100/-0.0075. As mentioned previously, the bid/ask is calculated by subtracting the September corn price from the May corn price. So if a trader sold the May 14/September 14 corn spread at the market, they would be filled at the current bid of -0.0100. While this can easily be seen on the Depth of Market of the spread (bid is highlighted in green), it can also be calculated by subtracting the current asking price of September corn (5.0850) from the current bid of May corn (5.0750).

Any trades are educational examples only. They do not include commissions and fees.

One convenience of trading futures spreads is that the contract specifications are exactly the same as the outright futures contract. For example, the Depth of Markets above show that the tic values are 0.0025 cents for May corn, September corn, and the May/September corn spread. Also, notice that the bids and offers on the Depth of Markets above show that the liquidity for the May/September corn spread is very similar, if not better, than the outright May (front month) corn contract. More liquidity can often be found in futures calendar spreads versus the outright futures contracts, whether one is trading spreads in the energies, grains, or livestock markets.

Another benefit to trading futures spreads is that the exchange typically offers reduced margin rates for spreads, because spreads can potentially reduce the volatility of the market being traded and remove systemic risk from the trade. Despite these exchange policies though, spreads can often be as risky as an outright futures contract. To learn more about the benefits of trading futures spreads, you can discuss futures spread with your StoneX broker.

You must be logged in to post a comment.