If a trader would like to place an order to enter the market on a stop, that trader can place a profit target at the same time. It is acceptable to simultaneously place a profit target and place an order to enter the market on a stop, because the market will usually trade through and fill the stop order before the market reaches and fills the profit target. This is because, generally, a stop order that is executed to enter a market on a breakout will almost always trade between the market price and the target price; and since the target price is a limit order, it isn’t filled until the market reaches the target price or a better price. The exception to this rule is when a stop is jumped, which can happen in special cases that I will explain further into this article.

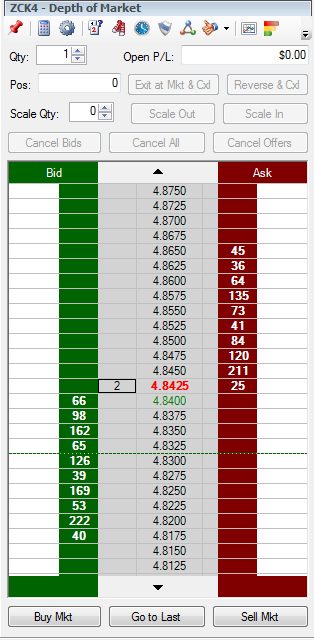

To illustrate a sequence where the market trades through, fills a stop order on entrance, and subsequently reaches and fills a profit target, let’s take a look at an example in the May 14 Corn market using the dt Pro Depth of Market application seen below.

Any trades are educational examples only. They do not include commissions and fees.

First, let’s imagine that a trader is looking to place an order to enter May 14 Corn on a stop at 4.8500 and place a profit target to sell at 4.8700 at the same time. Once the market reaches 4.8500, the stop order will turn into a market order and be filled at 4.8500 or higher, depending on where the next offer to accept the order is. Even if the trade is not filled at 4.8500 and slippage occurs, the profit target at 4.8700 will not be filled until the stop order at 4.8500 gets filled. This is because the stop order price was closer to the market price when both orders were executed.

As mentioned previously, in special cases, such as the release of a large report or an extremely illiquid market, stop orders can be “jumped”. Below are a few points to help you understand stop-jumping.

- When a stop order is placed, the exchange places a limit order within a specific range to protect traders from too much slippage. This range is known as Globex Non-Reviewable Trading Ranges – CME Group.

- If there are no bids or offers, or the market is moving too fast to accept an order within the protected range, a trader’s stop order has been “jumped”.

- Once the market trades outside of the protected range, the order will not be filled until the market trades within the range again, and there is a bid or offer to accept the order.

I recommend reading the article, Stops, Slippage, and Stop Jumping, to learn more about stop jumping.

Any trades are educational examples only. They do not include commissions and fees.

To illustrate how a stop could be “jumped”, let’s take a look at another example using the Depth of Market above. Let’s imagine that a trader places an order to Buy 1 May 14 Corn at 4.8500 and places an order to Sell 1 May 14 Corn at 5.1000 to exit at a profit. Once the initial stop order is placed at 4.8500, the exchange will place a buy limit order at 4.9500 to protect the trader from more than 10 cents of slippage. However, if there are no bids or asks to accept the order between 4.8500 and 4.9500, the initial stop order would be jumped, and the trader is susceptible to being filled at 5.1000 or higher to enter if the market continues rallying.

To help prevent stop-jumping issues, the trading platform, dt Pro, allows traders to place OSO (One Sends Other) orders. These orders allow traders to define a “main” order, stop loss, and profit target within one order entry. Once all orders are defined, the stop loss and profit target are “held” until the main order is filled. Ultimately, this prevents the stop loss or profit target from being filled before the initial order. To learn more about how to execute OSO’s on dt Pro, I encourage you to watch this video tutorial.

Entering a market with a stop order, whether to the upside or downside, is a great way to attempt to enter a market on a breakout in either direction. Placing a profit target at the same time is a great way to exit at a price if a trader thinks the breakout will end. This is a common method used to catch a breakout in either direction and is perfectly acceptable to execute.