Stop orders can be used in futures trading as a great way to help manage risk and protect losses, lock in profits, or enter the market on a breakout. The downside to using stop orders, however, is slippage. Slippage is the difference between the price a trader intends to execute a trade, and the price the trade is actually executed. Slippage is primarily caused by a lack of liquidity in a market and often causes trades to be executed at undesired prices.

Liquidity is simply a measure of the ease of ability to enter and exit a market at a desired price based on the amount of buyers (bids) and sellers (asks/offers) in that market. In a liquid market, such as the E-Mini S&P, slippage is not as common of an issue as in an illiquid market such as oats. Please view the following examples to have a better understanding of why slippage is more common in oats versus the E-Mini S&P, and how it affects fill prices on stop orders.

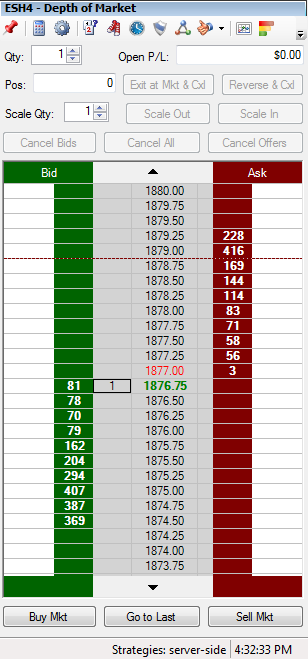

Let’s imagine that a trader is looking to enter an order to sell 4 E-Mini S&P at 1875 using a stop order to protect against a long position he currently has in the market. If we look at the following Depth of Market, one can see that there are 407 bids at 1875, so this trader should have no issues getting filled at 1875 if the market reaches that price.

Any trades are educational examples only. They do not include commissions and fees.

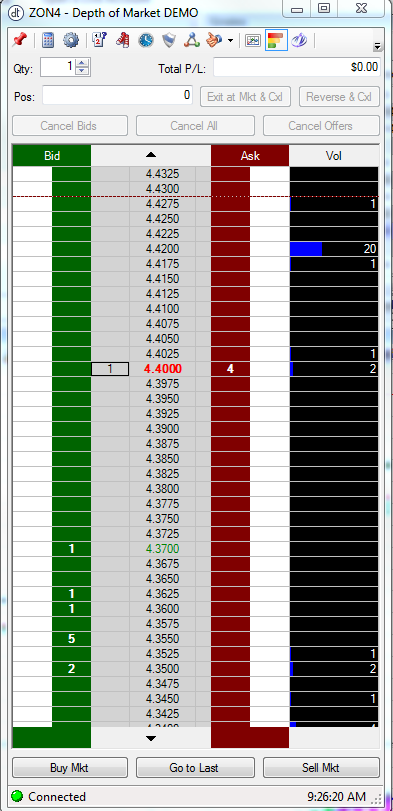

On the other hand, let’s imagine that a trader is looking to enter an order to sell 1 July 14 oats futures contract on a stop at 4.3900 to protect a long position. If the bids and offers listed on the Depth of Market remain the same as shown once the market trades through 4.3900, the trader will be filled at 4.3700. This is because there are no bids at the trader’s desired price of 4.3900, but there is one bid at 4.3700.

Any trades are educational examples only. They do not include commissions and fees.

As one can see in the above examples, the liquidity or lack of liquidity in a market is a very important factor when placing a stop order in that market. Liquidity is the ability to buy or sell a contract based on the level of trading activity in that market. Therefore, markets with high liquidity are easier to enter and exit at a desired price than markets with low liquidity, since there are more bids and offers at various prices in more liquid markets. For this reason, it is more common to place a stop order in a market with high liquidity because the trader has a higher probability of getting filled at his/her desired price.

Ultimately, stop orders can be used as excellent ways to enter the market on a breakout, or attempt to minimize losses or lock in profits on an existing position. However, it is imperative for trader’s to understand that stop orders are not always promised fills at the price they are executed due to slippage.