The market price and last traded price of a futures contract are often confused with one another. However, both have completely different meanings that are important for all traders to understand. If a trader does not understand the difference between the last traded price and the market price, the trader may be filled at an undesired price.

Last Traded Price

The last traded price is simply the last price that a trade occurred in a futures contract. The quote for the last traded price can be found under the last column or on a Depth of Market. Depending on the liquidity of a market, the last traded price could have occurred one second ago or one day ago. For example, in an illiquid market, such as deferred month oats, trades will occur very infrequently and will trade in wide price ranges. This often times results in the market price (bid and ask) being far from the last traded price.

Market Price

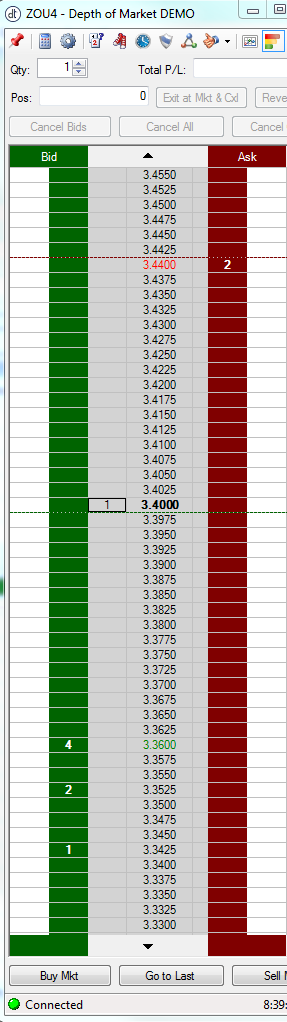

The market price, unlike the last traded price, is the price that a futures contract is either offered for, known as the ask, or the price someone is willing to buy a futures contract, known as the bid. The quotes for the bid and ask can be found under the bid and ask quote columns or highlighted in green (bid) and red (ask) on a Depth of Market (see below). If a trader is buying a futures contract, the market price is the asking price. If a trader is selling a futures contract, the market price is the bid price.

As one will see in the Depth of Market below for the September 14 Oats contract, the bid is 3.36 (in green), the ask is 3.44 (in red), and the last traded price is 3.40 (in bold black). This picture should not only help illustrate the difference between the last traded price, the bid, and the ask, but it should also show the lack of liquidity and how different the three prices are.

Any trades are educational examples only. They do not include commissions and fees.

Each bid and ask (market prices) have a certain size as well. The quotes for the bid size and ask size are listed under bid size and ask size in the quote columns or can be found on a Depth of Market, as one will see in the picture above. Depending on the liquidity of a market, the bid size and ask size can vary greatly. For example, in an illiquid market, such as September 14 Oats (Depth of Market shown above), one will notice that the bid size of 4 and the ask size of 2 is very small. Due to the lack of liquidity at the market prices, fills on multiple contracts, when placing market orders, can occur at the same price (if liquid), or completely different prices (if illiquid). For example, if one were to place a market order to sell 7 September 14 oats contracts, that trader would be filled on 4 contracts at 3.36, 2 contracts at 3.3525, and one contract at 3.3425. This should help illustrate how market orders in illiquid markets can drastically change the prices one is filled on multiple contracts.

Bid Price, Asking Price, and Last Traded Price

Ultimately, every product or service has a bid price, asking price, and last traded price. There is always a price a buyer is willing to pay (bid), a price a seller is willing to sell (ask), and a price the trade occurs (traded price). Using a house as an example, the last traded price is whatever price the house was last purchased and sold for. After the house is purchased and sold (last traded price), however, the market price is whatever price the owner is willing to sell the house (asking price) and whatever price a buyer is willing to pay for it (bid). Ultimately, until a bid meets the asking price, the next trade for that house will not occur. The same is true for a futures contract.