Spreading options allows traders to get involved in certain markets where the account size may prevent you from trading if it were using futures or long only options. You can design a trade specific to your feelings on market direction and time. You can combine calls and/or puts to make my trade as specific and targeted as we choose. We look at options trades like a musician looks at writing a song. By combining different notes (calls/puts), we can make my song (the trade) as unique or defined as you like. It can be complex or simple; it can be slow or fast — the combinations are endless.

In this article, we will discuss a different way you can combine options to take a specific idea and put it into action. Keep in mind that options spreads like these can be executed in any market. If there is a liquid options market on an underlying instrument, these spreads will be possible for you to trade. This strategy requires basic knowledge about calls and puts, and how to combine both short and long positions to create a spread. If you would like to learn about the basics of calls and puts,

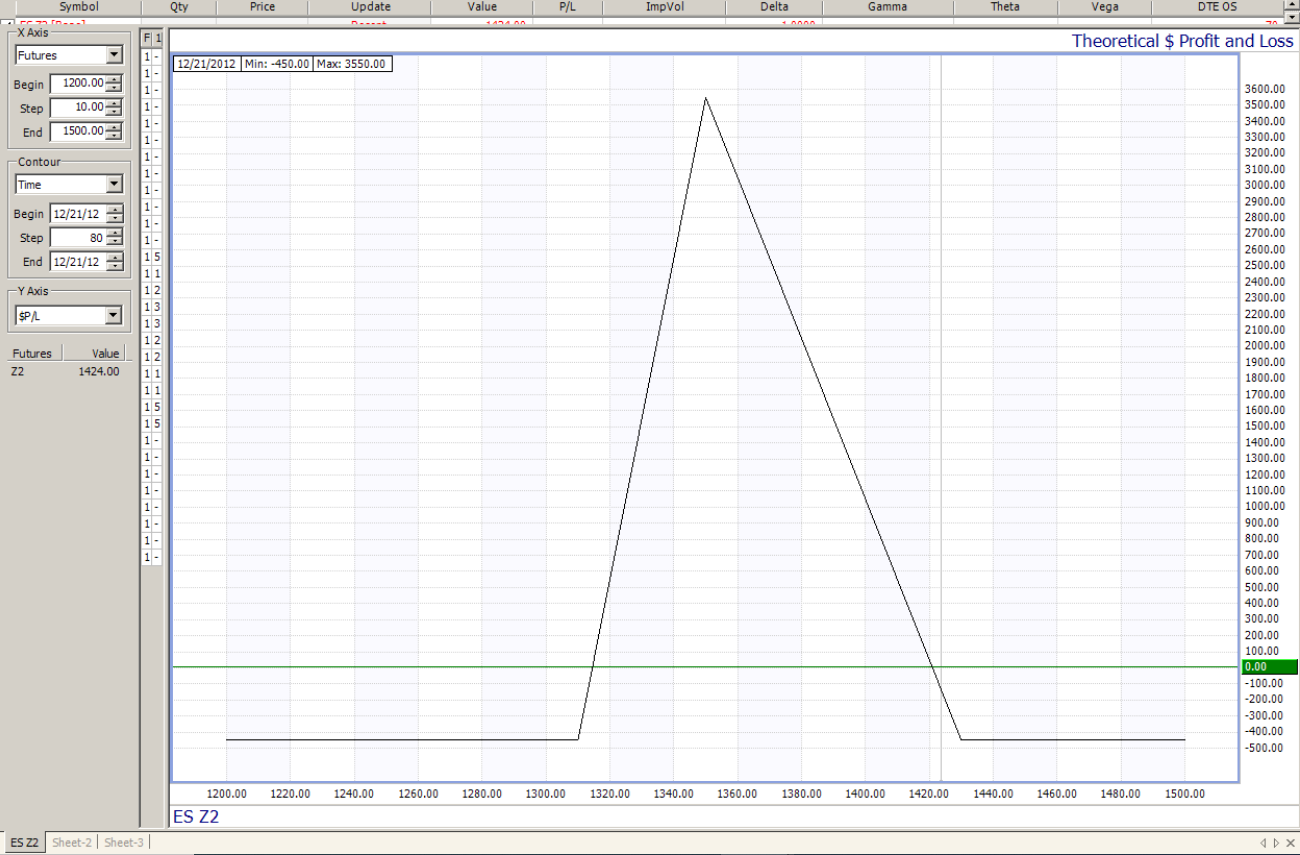

Let’s delve into an option position called the Christmas Tree Option Spread. This is a 6 leg option position involving the purchase of 3 calls/puts and the sale of 3 calls/puts (the trade will involve only calls or only puts). The idea behind a Christmas tree spread is that you have a directional bias in the market and a time frame in mind for when the price will get there. One will opt to use this type of spread instead of a more direct debit spread because the trader believes that the market will NOT go beyond a certain price by a certain date. If the price does go beyond that certain point on expiration, the trade will become a loser. That is the “rub” when using a Christmas Tree Spread strategy instead of a direct debit spread. In reality, this trade is a combination of three option spreads. One put spread purchase close to the money, and a sale of two out of-the-money credit spreads usually at the same strikes. This kind of trade can be difficult to explain in the abstract. I find a real-time example much easier to follow.

Any trades are educational examples only. They do not include commissions and fees.

Mike is a stock index trader. He sees that the S&P 500 is up almost 200 points for the year and believes that, due to the election and fiscal cliff, the market is due for a correction as the year ends. Mike has the three things necessary to make this strategy a fit:

- He has an idea regarding market direction

- That direction is quantifiable (meaning he can calculate the amount he believes the market will move)

- He has a time frame in mind

Because he has a hypothesis that fits, a Christmas tree spread is one of the appropriate tools he can use to make a profit from his idea.

Mike gives his broker a call, and the first step we will take to construct this spread is to find the instrument we want to trade. Because his hypothesis involves the stock market, we will look to the most liquid option market — the E-mini S&P 500. Mike has told me that his time frame is year end, so we will use the December options. These will expire on December 21, 2012 — 9 days before the end of the year.

Now that we have the options selected, we need to look at strike price. The strikes we choose will be paramount for two reasons:

- They will affect what we pay for the spread in terms of premium (our risk)

- Unlike a more direct debt spread, this spread will begin to lose money at a specific point. Picking a floor will be almost as important as choosing the close to the money strike we buy.

Where we place the strikes will be determined by Mike and where he feels there is a floor in the market. This is where his analysis will come in.

After thorough analysis, Mike believes the stock market will pull back by the end of the year to a slightly better than average annual return. Let’s say, 8%. As of this writing, the stock market is up 14% for the year (yes, you read that correctly).

From this level (1430 on Dec S&P at the time of writing), an 8% up year for the S&P would bring prices in line near 1356. It is at that strike where we will look to put our floor in. Now that we have decided on our strike prices, we need to build the trade.

Any trades are educational examples only. They do not include commissions and fees.

Mike will do the all of following at the same time by placing a multiple leg spread order in the market. That way, there is no “leg” risk. This means he won’t have to worry about the market moving between the fill of each leg because all 6 positions will be filled at once. (All prices are based on time of writing)

- Buy 1 1430 ESZ put for 40 points ($2000 paid out)

- Sell 3 1350 ESZ puts for 17 cents each or 51 points combined ($2550 collected)

- Buy 2 1310 ESZ puts for 10 points each or 20 combined ($1000 paid out)

- TOTAL COST / MAX LOSS OF $450 before fees

- MAX PROFIT OF $3550 before fees

Mike likes this type of trade for two reasons. First, the ratio of potential reward to risk is almost 8:1. Most debit spread traders are fortunate to find risk/reward. Second, the risk is fixed. He cannot lose more than $450 before fees. As a bonus, because this is a covered option position, Mike will have no margin to worry about.

However, there are negatives and risks about this trade, too. This is an expiration trade. This means that Mike will not make his potential maximum reward until expiration. If the market moves down sharply tomorrow, this trade will not profit much. Like a fine wine, the trade will only appreciate after time. Also, as you can see in the chart below, Mike could potentially lose money if the price would expire too low. If the price gets past the strikes we sell, Mike will start to lose profits. If it expires below 1315, he begins to lose his investment. The good news is that due to the covered options, he can only lose what he risked on the trade if prices fall anywhere below 1310. These are very important risks to understand before getting involved in a Christmas Tree Option Spread.

Below is an option graph to help you understand how much Mike will make, depending on where the option expires.

Any trades are educational examples only. They do not include commissions and fees.