What is a Trend Line?

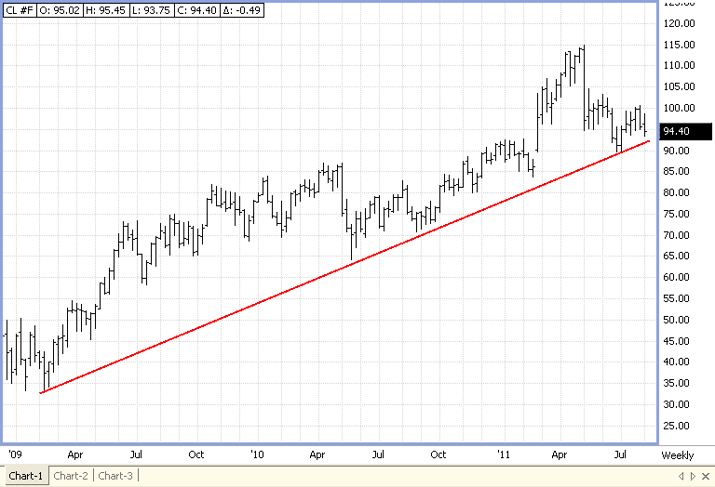

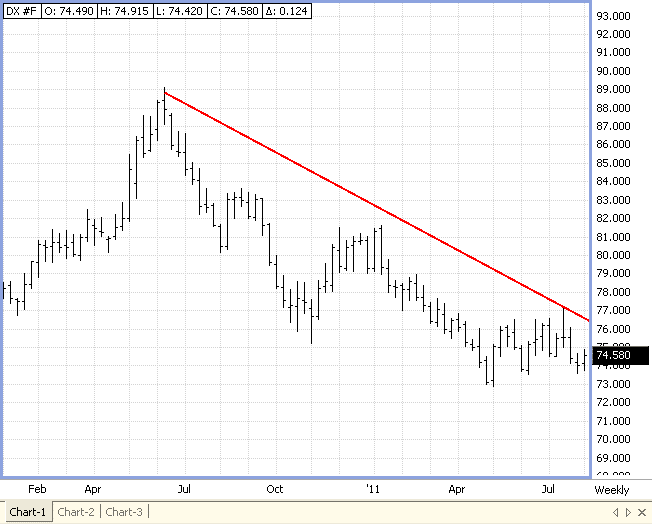

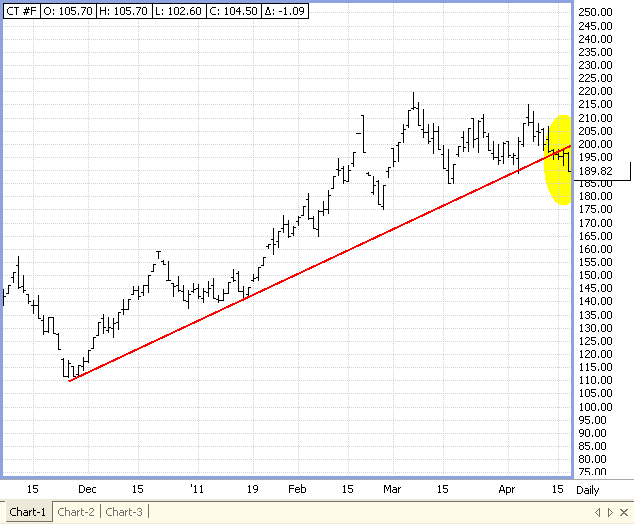

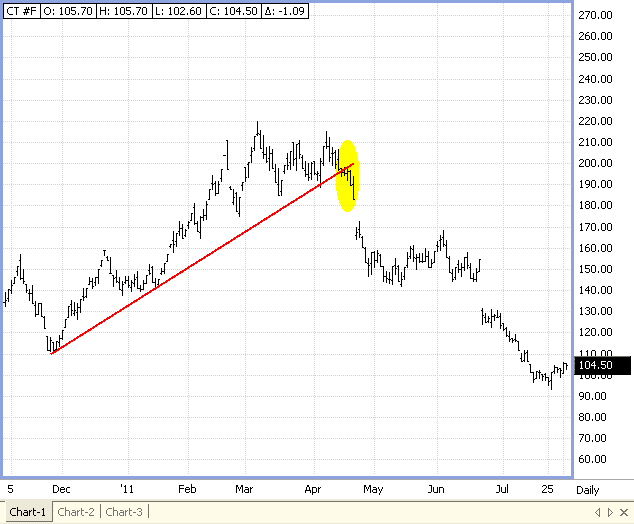

A trend line is an upward or downward sloping line on a chart indicating movements of prices over a period of time, generally occurring after two or more points of resistance or support. You can choose to trade a market based on support “holds”and resistance “setbacks”, or get involved in breakouts of the trend line. The more times market prices are turned away at levels of support or resistance, the stronger the trend line is perceived to be. This will invite further trading at these levels due to previous price reaction when tested.

Any trades are educational examples only. They do not include commissions and fees.

In my opinion, aggressive traders like to get in on trades before anyone else. They like to call tops and pick bottoms. They don’t mind being “early”. So if price action looks as if it will retest a strong trend line, they jump at the chance to put their orders in at or near it. This very function of trading is what provides that initial support or resistance; the front line, the defensive line. As this trading is taking place, other traders now see this level holding and they want in as well. Their actions give the market what it needs to “bounce” off the trendline. The price action now retreats to where it came from just a short time ago. This is the signal for the conservative trader who finds comfort waiting for the trend line to prevail before entering the market. Once this 3rd type of trader is satisfied, they enter the market and drive prices away from the trendline. This trend now has another “notch under its belt”. Once again, it has provided the necessary hold to keep the market trading in the upward or downward slope that we talked about when this article began.

Just as these trendlines promote involvement prior to trading at these levels, they also provide a catalyst for trading once they are penetrated.

There are traders who have been involved in a certain trading trend for a while and there are other traders who accumulate, or scale into, larger positions on every retracement or trendline hold. Plus, there are traders who just trade the trends. But every trend line has its day. There will be the trading session when the market closes outside that trend line. Close the windows and lock the doors because all of the above traders that I have been telling you about are going to want to get out of the market at the same time and around the same level! There is an old phrase that applies to this situation: the markets take the stairs up and the elevator down. This is what is known as a “break-out”. The market begins to trade extremely one-directional, either higher through levels of resistance or lower though levels of support.

Any trades are educational examples only. They do not include commissions and fees.

Now enter our final trading profile: the break-out trader. This style of trader looks for the exact type of price action described above and looks to capitalize on it quickly. In doing so, this type of trading continues to push the market through and away from the trendline that it can no longer hold.

Any trades are educational examples only. They do not include commissions and fees.

Trend lines provide distinction between emotional and analytical decisions. When holding a position in a trending market, removing the emotion behind a trade and letting the chart be your guide can make a big difference. A trend tends to remain intact until the underlying trendline has been broken. A trending market feeds off of healthy volume. This strong volume is a good sign to either get involved or stay involved in a particular market: The trend is your friend.

Trend lines can play a key role in risk management of a trade as well. Providing a market the necessary room to breathe allows one to base their exit strategies using more of an analytical method. In my opinion, the more emotion that can be removed from trading decisions, the better.

By placing protective stops directly through a trendline is a common thought process. And why not, it makes sense. The thought process being: if we trade through the trendline, I want out of this market. In essence, a trader will let the market trade freely via normal market price action and only look to exit should the trendline fail to hold. At which point the trader lets the chart tell him that the market has technically changed and it is time to exit. (Trading tip: above the resistance trend line for buy stops when short the market, and below the support trend line for sell stops when long the market).

Being familiar with trend lines and being aware of trendlines can help not only in formulating a trade idea for entry, but it can also provide assistance to better your exit strategies and trade exits.