A butterfly option spread is a multiple option position that involves the simultaneous purchase of calls or puts with the sale of calls or puts. The way the spread will be established will depend on how bullish or bearish one is on a market. The same rule applies with other option strategies; there is no such thing as a free lunch. The more one pays for these spreads, the higher the profit potential will be. Butterfly spreads are easier defined as a bull call spread combined with a bear call spread. With the understanding that most option strategies like this are difficult to understand, let’s look at an example.

How to Construct the Spread

Many traders have been very bullish on the corn markets over the last few years. Due to very loose monetary policies and tight fundamentals, the corn market has been quick to rally on any bullish news. Lately, the heat wave that has come across much of the Corn Belt has created another potential rally from which to be profited. Kurt, a corn trader, believes corn will rally, but also believes there is significant demand destruction above 8.00. He also believes the market will have a hard time getting much over that hurdle. He is an option trader who enjoys the comfort of maximum risk/maximum reward trades. Further, Kurt enjoys sleeping at night knowing that he cannot lose more than he pays for a trade. In the case of a market that has a potential to rally he looks to his primary strategy, the bull call spread.

Any trades are educational examples only. They do not include commissions and fees.

Normally, a bull call spread would be his preferred way of capturing gains from a bullish market, but, because he feels that 8.00 corn will not be demanded, he wants to sell the market over that price. Thus, he is going to combine two option spreads to form a butterfly call spread. He will buy one close to the money call, sell two further out of the money calls, and buy one even further out of the money call. Here is how his option spread will look with September corn trading at 6.90:

- Buy 1 725 September Corn Call for 25 cents – Pay $1250

- Sell 2 8.00 corn calls for 8 1/4 cents each (combined 16.5 cents) and collect 825

- Buy 1 8.75 Sep corn call for 3 cents – Pay $150 dollars

Kurt will end up paying $575 for this spread before fees, which will be his maximum risk on the trade. His maximum profit will be achieved if Corn settles at 8.00 on August 26. If that happens, he will make a profit of $3175 (spread value at expiration of $3750 and cost paid for the spread $575).

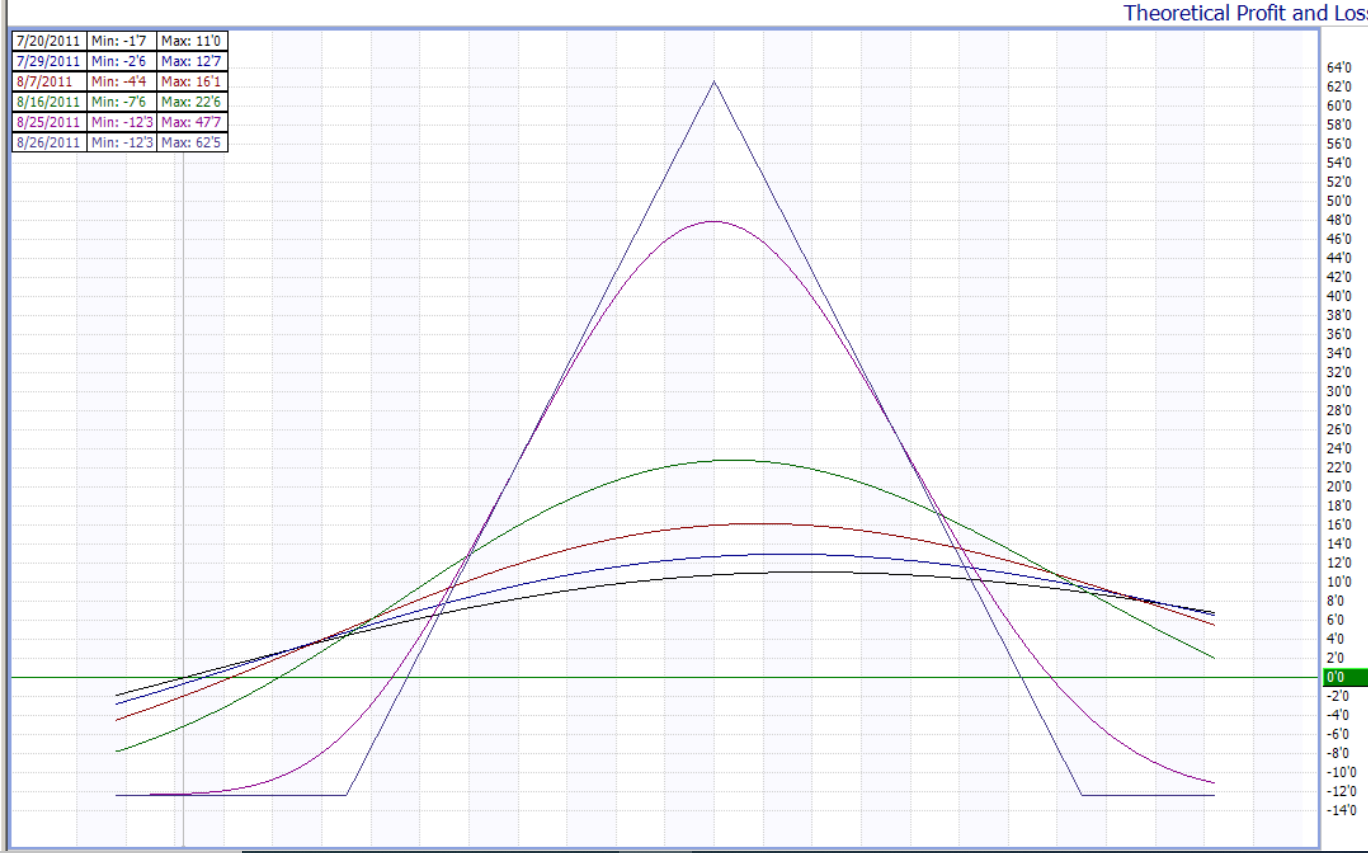

8.00 will be Kurt’s maximum profit point. If this were just a 725-800 call spread, Kurt would be happy to see the market rally as far as it can. His only desire would be that Sep Corn expires over his short 8.00 call so his max profit will be achieved. Keep in mind he would have paid $838 dollars for that spread. Because he sold an additional 800-875 call spread he will be losing money for every cent the market expires over 8.00. If the corn market rallies and expires over 8.75, Kurt will actually be taking a loss on the trade of the premium paid. His profit/loss is broken down on the theoretical option chart below.

Corn Chart

For those new to these kinds of charts, we want to focus on the blue straight line. This is the profit line of the option spread at the corresponding price of corn on Aug 26, the day of expiration. The other lines show profit at different points before the option expires. As you can see, by selling the 800-875 call spread along with the purchase of the 725-800 call spread he is trading off the profits over 8.00 for the ability to spend/risk less initially on the trade. The chart shows that a Sep Corn expiration above 8.75 will yield the same loss as an expiration below 7.25. So we are essentially using options to pin down an exact point where we believe the expiration will occur. With these types of strategies it is important to realize we are playing with the expiration price and not where corn prices will be next week or any time prior to expiration. We will always have the ability to exit the trade whenever we choose, but we will only achieve the maximum profit upon expiration.

Any trades are educational examples only. They do not include commissions and fees.

The flexibility of options to create spreads like these are one of the best reasons to trade them. Kurt can use a combination of spreads to design a strategy for exactly what he believes will happen. Whether you are using spreads as protection or as speculative tools, it is important to know the different ways their use can be a productive tool.