How difficult do you find it to enter into the market? If you think about it, “getting in” is not that difficult. The common problem that many traders face is not getting into a trade… the problem lies in the exit plan or when to get out. In this article we will discuss how some brokers assist their client’s methodology of exiting the market.

Conquer the pitfalls of greed and fear:

- Place stop orders to protect profits and limit orders to capture profits.

- Always accept profits when objectives are reached.

- Never adjust your stop order to allow more risk.

- Never deviate away from your initial trading plan.

- Setting stop orders to limit losses.

We can argue that finding an exit point is more difficult than finding an entry point. Entering the market can be easy. Your entry price is primarily driven by your level of confidence as well as aggressiveness. Being very confident would translate into either a market order or close limit order. If you like the idea but remain cautious, perhaps you would find comfort in a bit of confirmation and put your entry price in a stop order form and have patience to let the market come to you. Stop orders typically seek directional confirmation. While apprehension, greed and fear may be present at trade entry, they are typically more controllable at this stage. They are based on the unknown and definite profits or losses are not present to more intensely challenge the decision making process.

Without a specific strategy in place, exiting a position invokes plenty of emotion and racing thoughts; greed versus fear coupled with the lack of a plan and stubbornness. Level headed thinking and decision making needs to become the overriding thought process in order to breed successful trading. Follow this 2 pronged strategy: First, realize a bad trade as soon as possible, accept it, and exit for a small loss before it gets worse. Second, capture profits on a successful trade by use of a limit order, stop order or exiting the trade all together. Formulating and adhering to a plan upon entry into the markets ensures a “no-surprises” course of action and should always be implemented.

Those concepts are easy to understand. The troublesome part is the patience and discipline to stay true to the trade. Profit objectives and loss limits become compromised when levels are reached. When a profit objective is attained, successful trades need to be exited. Unfortunately, greed rears its ugly head. So often these trades can be held onto a bit too long, while visions of grandeur dominate the psyche, meanwhile retracements erase portions of said profits. When a loss limit is breached, unsuccessful trades need to be exited immediately. Unfortunately, fear and stubbornness becomes the norm. Common thoughts are those of “hope”, which never should be considered a trading strategy.

It can be valuable to place stop orders to protect and lock-in profits. Once a trade has begun to move in your favor, setting a stop order ensures that under normal market activity your risk becomes less as you approach your reward objective.

This, however, is not the end of actively practicing money management. Continuing to adjust your stop order (or utilizing a trailing stop) as the market moves in your favor leaves nothing to chance regarding a successful trade. When an initial profit objective is deemed acceptable and placed for any particular trade, it is important to remain willing to exit the trade at this level.

When you begin to compromise your initial intentions with those of the possibility of greater returns, greed has officially overcome your train of thought. So often traders get involved in a losing trade and begin to mentally talk themselves into accepting more risk in hopes that the trade “just needs more time”. They fail to accept the fact that they were wrong in their entry point and allow ideas of a market reversal to cloud their judgment.

Below are some common thoughts of a trader enveloped with greed and without a plan:

- I have made a good trade… I will stay in my position and make it a GREAT trade.

- I want more profits on this trade… I will buy the bottom and sell the top.

- I think it is time to exit… What if there are more profits to be gained?

- I am on the wrong side of the market… It just needs more time and it will start going in my direction.

Fear is an emotion that can be dealt with properly if handled before the onset of trading. Some can say, you are never more comfortable with a particular risk/reward level than you are when you first place that order. You have a very particular reason for choosing these entry and exit levels. That being said, knowing where you will be exiting the market upon placement of any order, whether it be for a profit or loss, provides a great deal of comfort to an inherently emotional situation. This action also allows the market to move freely within a trading range while still providing protection against adverse movement in price.

Below are some common thoughts of a trader dealing with fear of the unknown and without a plan:

- I like this trade idea… I don’t want to lose too much.

- I have a decent profit… Should I exit now?

- This trade has not turned out… Should I take a loss and move on?

- This trade was a bad idea… What am I going to do now?

Successful trading requires not only a well conceived plan to enter the market but, more importantly, a solid thought process anchored with preparedness for exiting the market. If realistic goals and comfortable levels of risk are established before trading, the overall exiting process is significantly less emotional. All things considered, removing emotion ahead of time should be the objective.

We help clients achieve the highest level of confidence possible prior to entering or putting on a trade. How do we accomplish this? By using a specific set of order execution contingencies that allow for optimal risk/money management before and throughout the life of a trade. Establishing a mutual climate of comfort is the first step towards forging a successful and lasting relationship.

Any trades are educational examples only. They do not include commissions and fees.

Trade Ideas:

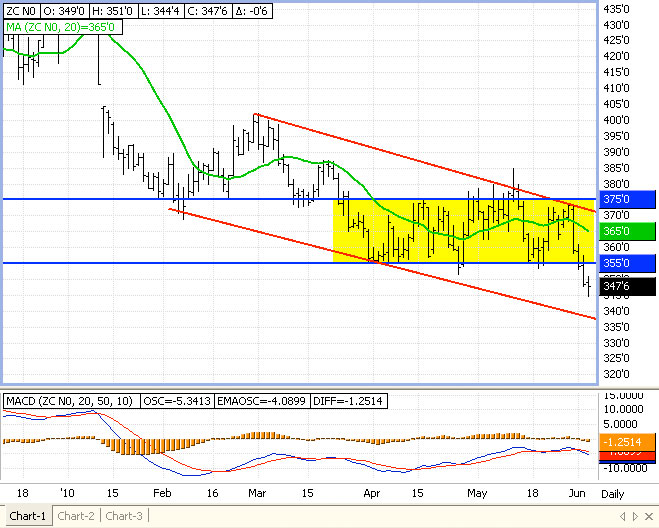

JULY CORN:

SELLING at 355’0

- Risk is 370’0

- Objective is 337’0

OCTOBER SUGAR:

SELLING at 14.35 on a STOP

- Risk is 15.05

- Objective is 12.50

Any trades are educational examples only. They do not include commissions and fees.

AUG GOLD:

BUYING at 1197.0

- Risk is 1170

- Objective #1 is 1230.0

- Objective #2 is 1250.0 to 1282.0