There has been a lot of myths and confusion in regard to iron condors, so we'll attempt to break this down for you in simple, easy-to-understand language. In order to accomplish this, we need to have a basic understanding of credit spreads.

Understanding Credit Spreads

A credit spread is when you sell a closer to the money (more expensive option) and purchase a cheaper (further out of the money option) on the same underlying commodity at the same expiration.

Any trades are educational examples only. They do not include commissions and fees.

Let’s take a look at an example using gold futures;

| Gold futures | = | 1400 |

| 1350 puts | = | $3500 |

| 1300 puts | = | $1500 |

Gold futures are trading at 1400 and we feel bullish on this market. We could sell a 1350 put and purchase a 1300 put. The premium in the 1350 put is going to be higher than the 1300 put because it is closer to where the market is currently trading. We would collect the $3500 premium from the 1350 put and pay out the $1500 premium of the 1300 put at a net credit on the trade of $2000. Our defined profit is the amount we collected between the 1350/1300 put spread, $3500 – $1500 = $2000. We’re risking the difference between our two strike prices, (1350 – 1300 = 50 x $100/point = $5000. And, since we already collected a premium of $2000, our defined risk is reduced to $3000 ($5000 – $2000 = $3000).

So… What is an Iron Condor?

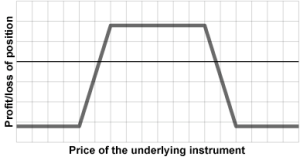

An Iron Condor is simply a combination or two vertical spreads. To create the iron condor, we would sell both a call spread and a put spread. The idea behind this is to take advantage of a sideways market and allow us to design a strategy based on where we feel the market will NOT go.

How to Use an Iron Condor Strategy

Once again, let’s take a look at an example using gold futures.

The current price of gold is 1400. We feel that the market will likely trade within a channel between 1350 and 1500 over the next 30-60 days. Gold options are currently trading at the following prices:

| 1500 call | = | $3500 |

| 1550 call | = | $1500 |

| 1350 put | = | $3500 |

| 1300 put | = | $1500 |

In order to take advantage of a sideways market we would use an iron condor by selling the 1500/1550 call spread and the 1350/1300 put spread.

Any trades are educational examples only. They do not include commissions and fees.

How to Calculate the Profit Potential

We would place an order to sell the 1500 call and purchase the 1550 call. We would collect $2000 premium on our call spread ($3500 – $1500 = $2000). We would also sell the 1350 put and purchase the 1300 put. We would collect another $2000 premium on our put spread ($3500 – $1500 = $2000). This would define our profit potential to $4000 (total premium from call spread + put spread, $2000 + $2000 = $4000).

Maximum Profit Potential = Call Spread Premium + Put Spread Premium

How to Calculate the Defined Risk

We can also use these numbers to calculate our defined risk. Our defined risk is the difference between our spread strike prices minus the amount we collected. Since we have both a put and call spread, we know our risk is limited to only one side. The market cannot expire above our call spread and below our put spread simultaneously, so we have a risk of just $5000 (1350 – 1300 = 50 x $100/point = $5000 or 1500 – 1550 = 50 x $100/point = $5000). Note: If the difference between our strike prices were not balanced, we would use the greater difference. However, this is before we take into account the premium we collected. We have collected a total of $4000 for our put and call spreads upfront, so we can deduct this from our risk total. Thus, our defined risk would be reduced to $1000 ($5000 – $4000 = $1000).

Defined Risk = Greater Difference between Strike Prices – Premium Collected

Benefits of an Iron Condor Trading Strategy

Now that we understand what an Iron Condor is, we need to understand why we would want to use this trading strategy. Buying options are great in regard to their risk reward. You can define your risk to a very small sum, while having unlimited profit potential. The downside of this strategy is the probability. The majority of cheap, far out of the money options will expire worthless. So although you are only risking a few hundred dollars on each option, the odds of these being profitable are low.

That being said, if the majority of options are going to expire worthless, then why don’t we just sell options? You can, but you are running the risk of that one cheap option turning into a very valuable option. So you might have a defined profit a few hundred dollars with unlimited risk.

This is why the Iron Condor is an attractive strategy. You are doing your part managing your risk because you know what the worst outcome can be. You are also keeping the odds in your favor. We know that the majority of all out of the money options are going to expire worthless, so we should have more profitable trades than losing trades.

In conclusion, an Iron Condor can be a simple strategy. It is a combination of two credit spreads: one to the call side and one to the put side. This allows you to take advantage of sideways markets and to design a strategy based on where you feel the market will NOT go. This strategy allows you to define your risk, while keeping the odds in your favor, and providing you with a flexible and disciplined approach to the markets.

You must be logged in to post a comment.