Many traders are constantly looking for a way to manage risk. Employing a delta neutral trading strategy can help to manage exposure to the markets. This type of strategy will allow speculative traders to hedge their positions against adverse price movements.

How Does a Delta Neutral Strategy Work?

A delta neutral trading strategy involves the purchase of a theoretically underpriced option while taking an opposite position in the underlying futures contract. A common question traders have after this explanation is, “How do I know if an option is theoretically underpriced?” I prefer to use a futures trading platform that provides this information.

This example below looks at purchasing December gold calls and selling the underlying gold futures contracts. See the screenshot below:

Any trades are educational examples only. They do not include commissions and fees.

We are going to focus on the 1360 December gold calls. The last traded price was 1960, the bid-ask is 2010 by 2050, and the theoretical price is 2503. With the bid ask being where it is, we’ll assume we can buy a 1360 call for $2030. Notice that the theoretical price is $2503. This lets us know that the option is undervalued by $473. Knowing that the option is greatly underpriced, we would want to take advantage and buy calls.

The next question traders have is how to figure out how many underlying futures contracts to sell. The option’s delta will give you the answer. A call option will always have a delta value between 0 and 1.00. Many traders drop the decimal points, and we’ll do the same. If you look at the above screenshot, you’ll notice the far left column let’s you know the option’s delta. In this case, a 1360 call has a delta of 49. This means that one 1360 call will be the equivalent of 49% of an underlying contract. Options that are at-the-money will always have a delta of around 50. In-the-money options will have a greater delta than 50 and out-of-the-money options will have a delta lower than 50. The underlying futures contract will always have a delta of 100. In order to find the number of futures to short to be delta neutral, simply divide 100 (delta of underlying) by the option’s delta. For the above example, you would divide 100 by 49 and get ~ 2/1. So, for every two gold call options purchased you would sell 1 gold futures contract.

Since we are purchasing calls, their delta will always be positive. Since we are selling the underlying futures, their delta will be negative. The goal is to for the combined deltas to be as close as possible to zero when added together. So, for the example above we purchased two options with a delta of 49 for a total delta of +98. We then sold an underlying futures contract that has a delta of -100. Our total delta is -2 (-100 + 98). It isn’t zero, but it’s extremely close.

Any trades are educational examples only. They do not include commissions and fees.

Make Adjustments to Remain Delta Neutral!

Once in the position, it is important to make adjustments in order to remain delta neutral. As the price of the position moves, so does the delta. An increase (decrease) in price of the underlying futures contract will increase (decrease) the premium of the option, as well as the delta. Making adjustments along the way will allow for the position to be as close as possible to delta neutral. A trader can make adjustments hourly, daily or weekly. It is entirely up to him and what he is comfortable with.

A Delta Neutral Trading Strategy in Action

We’ll now take a look at a delta neutral strategy in action (Note: This is different from the screenshot and examples above. The similarity of the 1360 calls is a pure coincidence). On October 7th, a trader thinks that the gold market is due to continue in its bullish ways. December gold futures are currently trading at 1357. He will look to exit the position on or before November 3rd before the FOMC announcement. He decides that it is in his best interest to use a delta neutral options strategy in case his market outlook is incorrect. He finds that the December 1360 Gold calls are theoretically underpriced. He decides to purchase 10 calls for $3300 each. The delta for the options is 50. In order to be properly hedged, he will need to sell 5 underlying gold contracts to reach delta neutral.

Any trades are educational examples only. They do not include commissions and fees.

- Long 10 December 1360 gold calls for a total delta of +500 (50 * 10)

- Short 5 December underlying gold futures for a total delta of -500 (100 * 5)

- Total delta = 0

November 3rd is now here and the trader is still in the position. His 1360 calls are now worth $1640 and futures are currently trading at 1338. He decides to exit the position before the FOMC announcement. He offsets his options at 1640 and buys back his futures at 1338. The market did not continue its bullish ways. But, the trader was hedged so he should be fine, right? Let’s take a look:

Options:

$3300 (Premium paid per option)

– 1640 (Premium received for selling options)

$1660 loss per option for a total loss of $16,600 (1660 * 10 options)

Futures:

$1357

– 1338

19 points gained in futures

x $100 per point

+$1900 per contract for a total gain of $9,500 (1900 * 5 contracts)

Total Profit / Loss: –16,600 + 9,500 = -$7,100 loss, not including commissions and fees

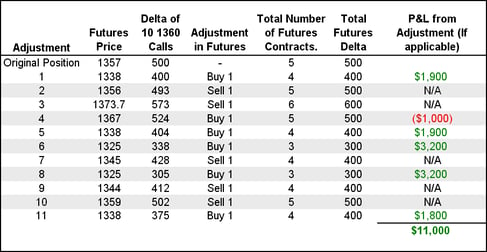

How did the position end up so poorly? The trader had a delta neutral position and should have been protected, right? Wrong. Take a look at the headline above entitled, “Make Adjustments to Remain Delta Neutral!” The market is constantly changing; therefore the delta is always changing. In our example, the trader actually made 11 total adjustments throughout the time he was in the trade as the delta increased or decreased, and his result turned out differently. See the chart below:

As the price of the underlying contract decreased, the delta decreased as well. In order to get back to delta neutral, the trader had to buy a contract back, essentially forcing him to buy at a low. When the price of the underlying contract increased, the delta increased as well. In order to get back to delta neutral, the trader had to sell a contract, essentially forcing him to sell at the high. When the time comes to offset, his positions look as such:

Any trades are educational examples only. They do not include commissions and fees.

Offsetting All Open Positions

| Long 10 Dec 1360 Gold Calls | (33,000 – 16400 = -$16,600) |

| Short 1 Dec Gold Futures Contract at 1373.7 | (1373.7 – 1338 = $3570) |

| Short 1 Dec Gold Futures Contract at 1345 | (1345 – 1338 = $700) |

| Short 1 Dec Gold Futures Contract at 1344 | (1344 – 1338 = $600) |

| Short 1 Dec Gold Futures Contract at 1359 | (1359 – 1338 = $2100) |

So, let’s take a look at the profitability of the trade with the adjustments:

-16600

+11000

+ 6970

+$1,370, not including commission and fees

The adjustments made all of the difference. There was only one case where the trader had to accept a loss to get back to delta neutral. The adjustments to get to delta neutral helped him take advantage of the theoretically underpriced option even when the market went in a different direction than he originally anticipated. Using a delta neutral trading strategy won’t always produce a profit, but it is a great strategy to help manage risk. The example above uses a larger initial position, but the same principles can be employed with a much smaller initial position.